nebraska car sales tax form

The Nebraska state sales and use tax rate is 55 055. Complete Edit or Print Tax Forms Instantly.

How To Get A Resale Certificate In Nebraska Startingyourbusiness Com

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective January 1 2023 Updated.

. For Motor Vehicle and Trailer Sales. Guaranteed maximum tax refund. Free means free and IRS e-file is included.

To sign over the Nebraska vehicle title you and the buyer. Nebraska SalesUse Tax and Tire Fee Statement. My Nebraska Sales Tax ID Number is 01-_____.

A completed Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6. Easy Online Legal Documents Customized by You. Start and Finish in Minutes.

Updated August 25 2022. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above. PURCHASERS NAME AND ADDRESS SELLERS NAME AND ADDRESS.

Ad Free tax filing for simple and complex returns. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. IRS Form W-9.

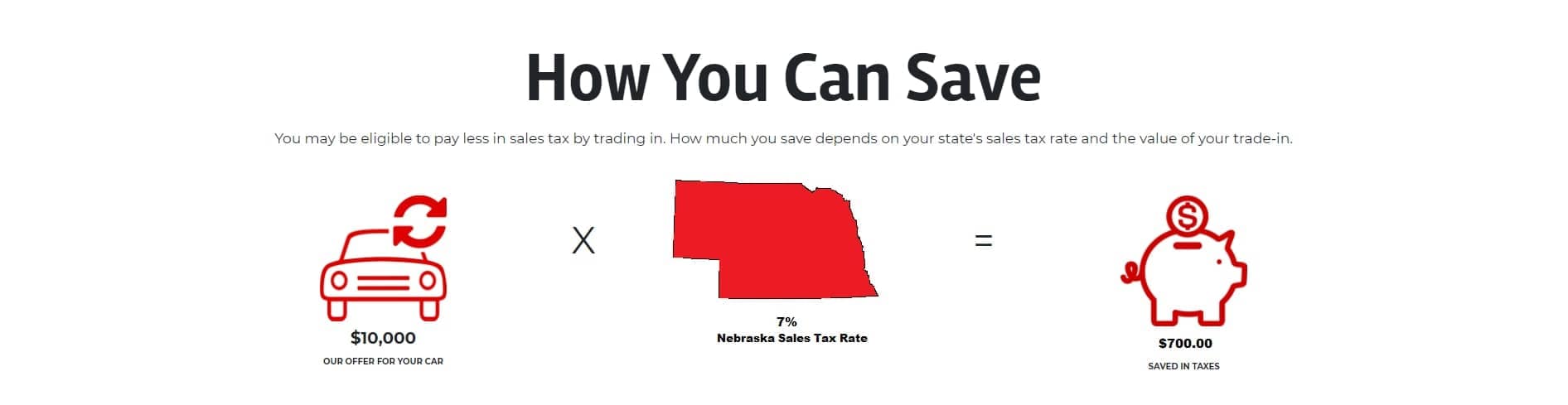

If none state the reason _____. Therefore your car sales tax will be based on the 40000 amount. Ad Legal Forms Ready in Minutes.

Registration Fees and Taxes. Sales and Use Tax Form 17 to the Form 13 and both documents must be. That physically become part of.

You will subtract the trade-in value by the purchase price and get 40000. 00211A If the person files a. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Avalara can help your business. Custom Free Bill Of Sale Used Car Lot Available on All Devices. Tax lines of a Nebraska and Local Sales and Use Tax Return Form 10 submitting the form to the Department does not constitute the filing of a use tax return.

Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. Car Sales Tax on Private. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now.

Max refund is guaranteed and 100 accurate. Driver and Vehicle Records. Complete Edit or Print Tax Forms Instantly.

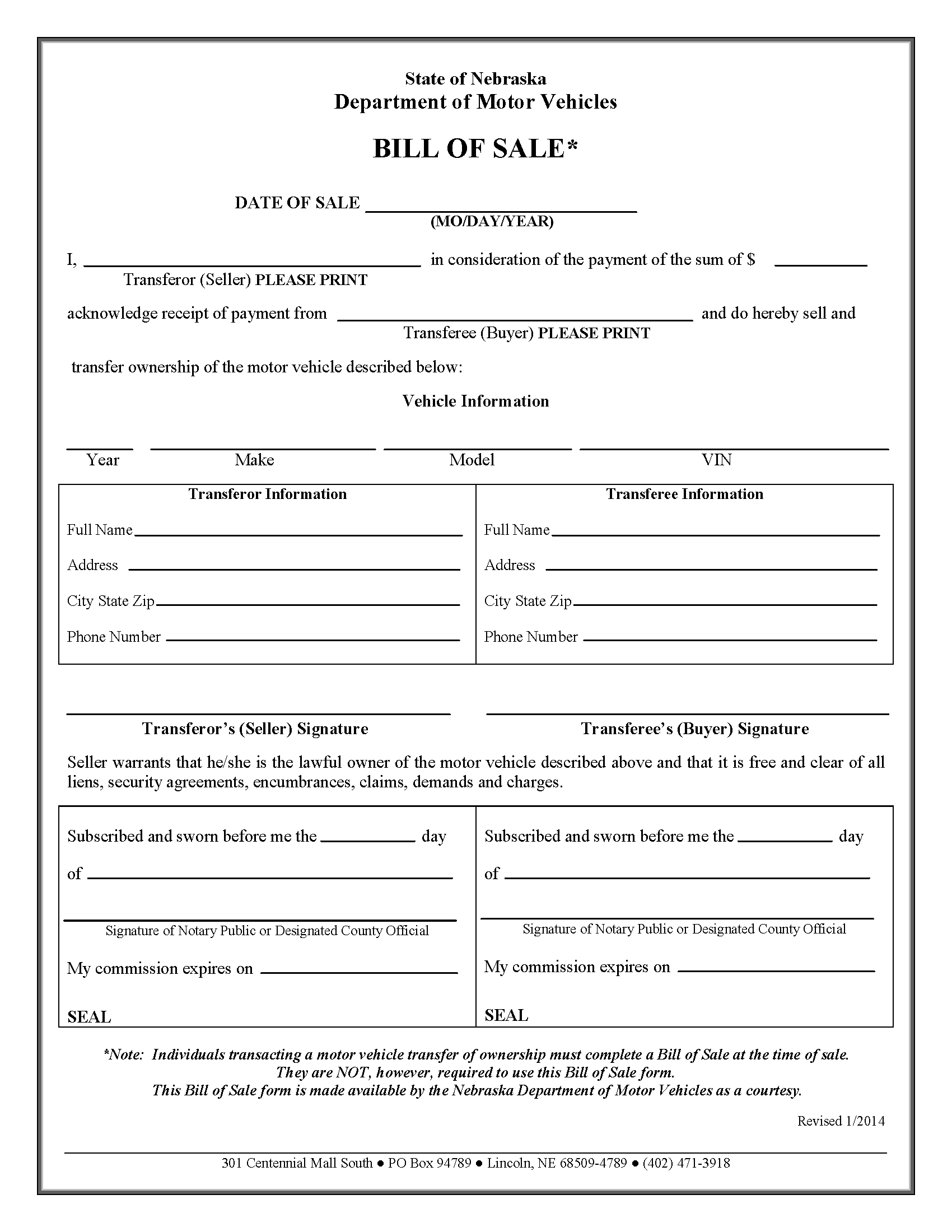

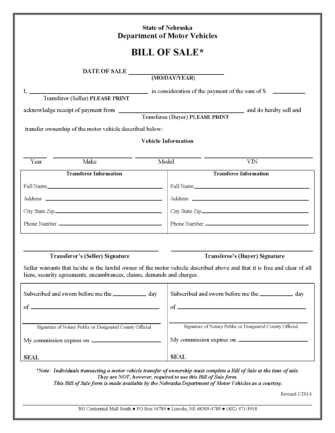

Ad Have you expanded beyond marketplace selling. Transferring Your NE Title. A Nebraska motor vehicle bill of sale is a legal document that provides information with regard to the seller buyer and vehicle to prove that a.

Prepare and file your sales tax with ease with a solution built just for you. Ad Download Or Email Form 6 More Fillable Forms Register and Subscribe Now. Nebraska vehicle title and registration resources.

IRS 2290 Form for Heavy Highway Vehicle Use Tax. Vehicle Title Registration. Nebraska Documentation Fees.

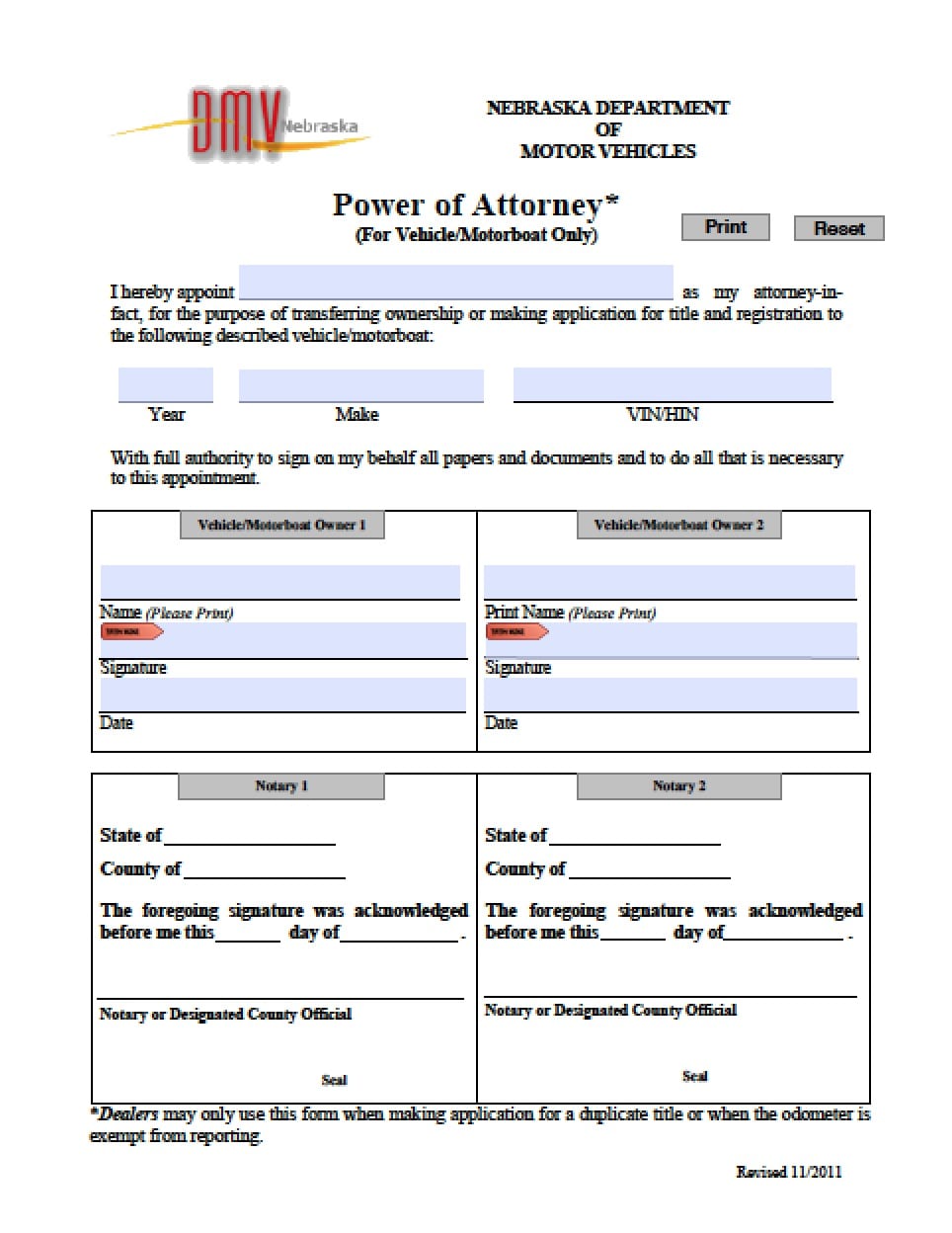

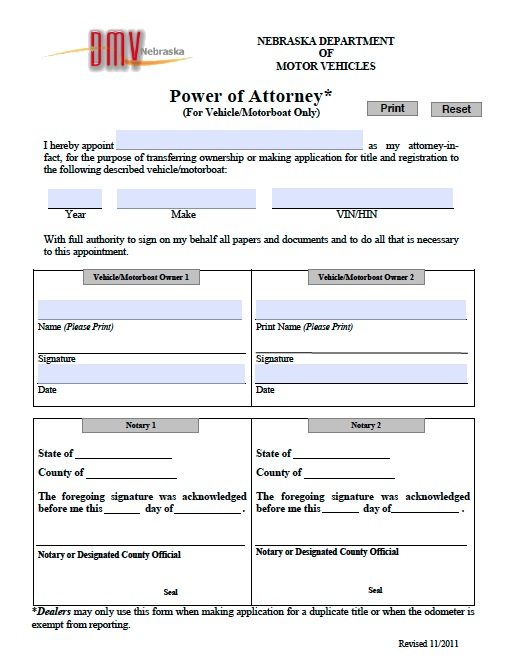

Nebraska Vehicle Power Of Attorney Form Power Of Attorney Power Of Attorney

Fill Free Fillable Forms For The State Of Nebraska

How To File And Pay Sales Tax In Nebraska Taxvalet

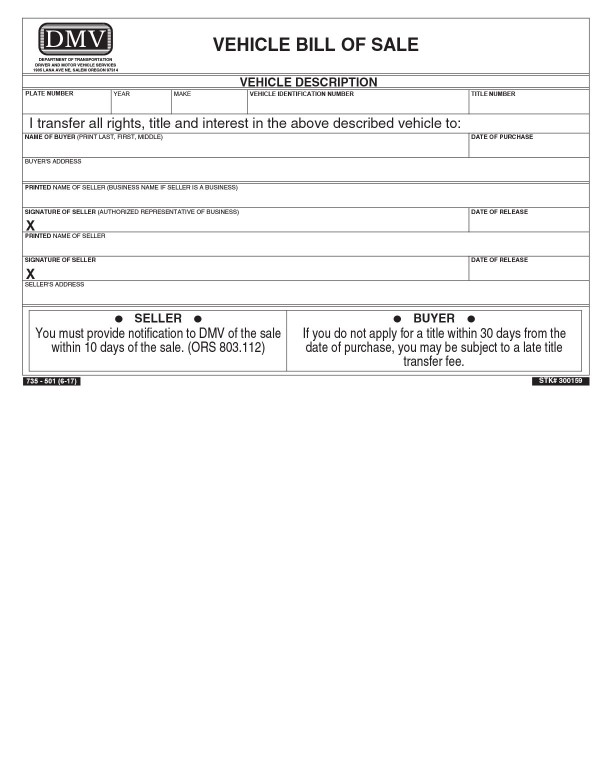

Oregon Bills Of Sale Templates Forms Facts Requirements For Selling Car Boat

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Free Vehicle Vessel Power Of Attorney Nebraska Form Pdf

Bill Of Sale Template Free Template Download Customize And Print

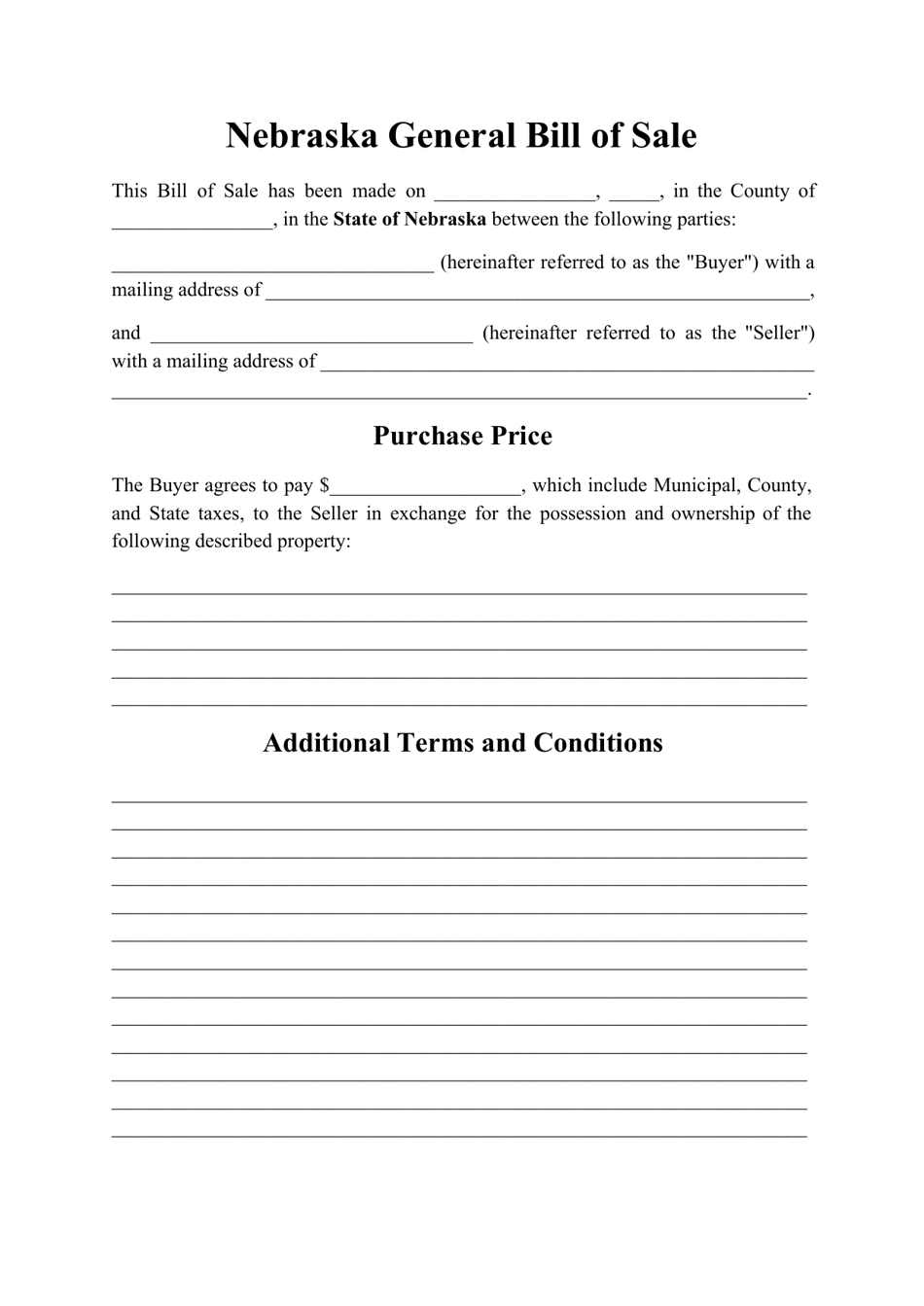

Nebraska Bill Of Sale Form Legalforms Org

Sales Taxes In The United States Wikipedia

Nebraska Sales Tax Small Business Guide Truic

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Eforms

Vehicle Registration For Military Families Military Com

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

We Buy Cars Schrier Automotive

-%20Reverse.png)

Nebraska Vehicle Titles Kids Car Donations

Bellevue Nebraska Police Department Pro Tip When You Alter Your In Transits Remember They Are Only Good For 30 Days In Nebraska This Vehicle Owner Made Them Good For 42 Days Out

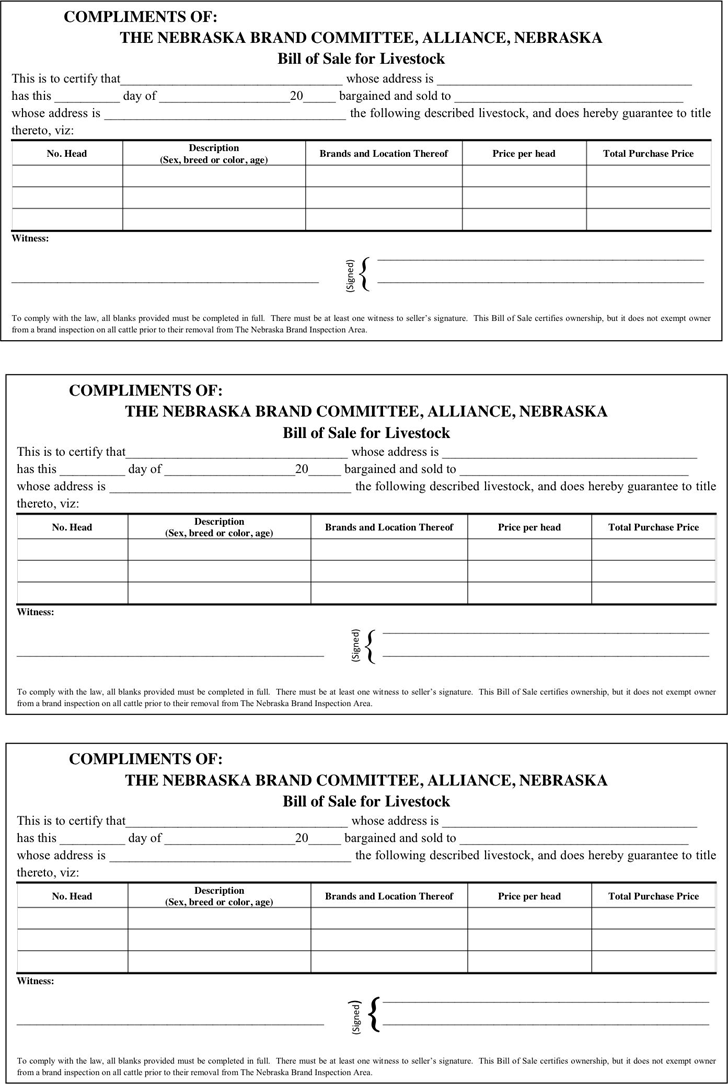

Free Nebraska Bill Of Sale Forms Pdf

Nebraska Generic Bill Of Sale Form Download Printable Pdf Templateroller